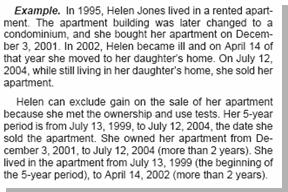

Obama won, Grover Norquist lost

2012 election results are in, and Obama won. President Obama should also win Florida. That means an electoral college tally of 332-206.

The U.S. Chamber of Commerce, which spent at least $28 million against Democrats, lost.

Represented by Chamber of Commerce

American Crossroads and Crossroads GPS, which spent $1 billion against the president and against Democrats, lost.

Karl Rove lost. Grover Norquist lost. Donald Trump lost. Rudy Giuliani lost. Rush Limbaugh lost. Charles Krauthammer lost. George Will lost. Bill O’Reilly lost.

(Here from YouTube is Rove, on air, trying to dispute the outcome in Ohio: http://www.youtube.com/watch?v=eQLV7nqD3CA)

The grotesques lost.

‘Winners’ and ‘losers’ are worse than useless as words. The winners-and-losers language cannot be trusted, anyway, as to validity. The commentators most eager to identify winners and losers self-identify as less eager to nail accuracy; a vulgar mindset characterizes notable non-wizards. I do not want to sound as though I were auditioning to become one of the sillies.

But clearly on election day 2012 some won, some lost.

The president

Won:

President Obama and Vice President Joe Biden won re-election, and rightly so. They won the popular vote as well as the electoral college. For the first time since 1936, they won re-election with over 50 percent of the popular vote.

FDR

Several deserving Democratic senators won hard-fought re-election in an avalanche of negative advertising, including Sherrod Brown in Ohio, Joe Manchin in West Virginia, Bill Nelson in Florida, and Jon Tester in Montana.

Massachusetts Senator-elect Elizabeth Warren

Elizabeth Warren won in Massachusetts, Claire McCaskill won in Missouri, Tammy Baldwin won in Wisconsin, Heidi Heitkamp won in North Dakota, Mazie Hirono won in Hawaii. There are now twenty women in the United States Senate–a record. The senate is better off with such women Democrats.

Alan Grayson won as U.S. Rep in Florida, rightly so.

Tammy Duckworth won for the House in Illinois, in the process defeating the disgraceful Joe Walsh. The swing from awful to good is even bigger than the outcome.

Lost:

Lackluster corporate ally Mitt Romney and Paul Ryan, the author of the Ryan so-called budget, lost. (Rep. Ryan won re-election to the House.)

Rep. Allen West lost decisively in Florida. Way past due, but better late than never.

GOP Senate candidate George Allen lost in Virginia.

Rep. Joe Walsh lost in Illinois.

Big money lost.

The Koch brothers, who spent tens of millions on the election, lost.

Sheldon Adelson, who donated tens of millions first to Newt Gingrich and then to Mitt Romney, lost.

The Chamber of Commerce losses and the losses of Rove’s groups, the losses incurred by all the super-PACs massed on the pro-corporate, pro-tax haven, anti-union side of the aisle, are the biggest money losses. But it is worth mention again that wealthy self-funding candidates also lost. Linda McMahon lost in Connecticut; Steven Welch lost to incumbent Sen. Bob Casey in Pennsylvania; most others lost in primaries. The national political press could have seen an augury for fall 2012 in the losses of so many self-funders.

Along with the billionaires and millionaires, corporate executives who stepped off the sidelines to bully the political process through their workplaces lost.

Speaking of losses, the long string of candidates who lost the race for the GOP nomination lost again. They did not help Republicans look better in the general election. Remember the parade–the string of fallen candidates from the GOP campaign trail—Rick Perry, Newt Gingrich, Herman Cain, Rick Santorum, Tim Pawlenty, Michele Bachmann. None can claim—although that won’t keep them from trying—that the election outcome enhances his individual credibility, or that they enhanced the party’s credibility.

Republicans lost. They lost the presidential race; they lost seats in the senate; they lost seats in the house; and they lost seats in the state legislatures. Only in governorships did the GOP eke out an advantage, and even there, with more to defend, Democrats kept or took five governorships including the hard-fought governorship of West Virginia.

Sen. Minority Leader Mitch McConnell (R-Ky.) lost.

House Republicans lost. They lost their two ugliest members, they lost some of their ‘base’, and once and for all the scorn of establishment Republicans for the anti-abortionists was clarified for all to see.

Won:

Democrats won. Not all state tallies are complete, but enough returns are in to clarify a nationwide pattern.

Democrats gained two seats in the senate, giving them the edge 53-45. Of two independents–Vermont’s Bernie Sanders and Maine’s Angus King–at least one will caucus with the Democrats. Given the quality of the new Democrats elected, that means the Democrats are stronger now than with the nominal ‘filibuster-proof’ sixty they had in 2009, relying on Joe Lieberman.

Democrats gained at least six seats in the house. In a notable upset, physician Raul Ruiz defeated GOP Rep. Mary Bono Mack in California. (Bono Mack’s husband, Connie Mack, also lost his senate race in Florida.) Dem Pete Gallego beat Quico Consego in south Texas. Lois Frankel beat Adam Hasner in South Florida. If Scott Peters has beaten Rep. Brian Bilbray in California, the gain is at least seven for Dems.

In the states, Dems gained the New Hampshire Executive Council. Democrats flipped at least eight state chambers from Repub to Dem in 2012, including chambers in Colorado, Maine, New Hampshire, New York and Oregon, losing only two. Early estimates are that Democrats picked up 200 seats in state legislatures, partly making up for the large losses of 2010. Local races parallel the federal and state patterns.

Lost:

Media grotesques lost.

Charles Krauthammer and Rush Limbaugh lost, as mentioned. George Will and Bill O’Reilly lost. Sarah Palin lost. Sean Hannity lost. Dick Morris lost.

The rightwing noise machine lost.

Fox News lost.

Rupert Murdoch lost.

The Wall Street Journal lost. The Chicago Tribune lost.

A host of auxiliary right-wing pundits installed by the newspaper I subscribe to, the Washington Post, lost. David Gergen lost. For that matter, most pundits lost. Dan Balz lost. The WashPost‘s layout editors–whoever composed the unfavorable headlines and picked the disfiguring photos of Obama–lost. George Stephanopoulos’ Round Table on ABC’s This Week lost. Face the Nation lost. Meet the Press lost. Chris Matthews lost.

Many or most of the pollsters–except for Nate Silver–lost.

The middle class won. Some degree of tolerance won. Health care won. Social Security won. American labor won. Reproductive rights won. The U.S. automobile industry won. Collective bargaining won. College students won. Mortgage holders won. Banking customers won.

Unfortunately, Paul Ryan won re-election to the House. So did Michele Bachmann. We can’t have everything. Bachmann’s race was tight, though. In theory that should end any discussion of Bachmann as some kind of powerhouse. Still, politically progressives won. Racism lost. Anti-immigrant campaigning lost decisively.

I am not gloating. This is a celebration of improvement, of steps toward a cleaner and healthier body politic. People like Joe Walsh and Allen West never did have any place in public office and should never have gotten a federal office in the first place. Anyone who held the opinion that the election was Mitt Romney’s to win was never qualified to be a political reporter in the first place. Any writer who thought ‘the economy’ an issue that would work in Romney’s favor is unqualified to appear in print. Corporate managers who spent more time throwing their weight around than they did improving their companies never should have been managers in the first place. Corporate management should never have been so pinned to stock price in an imaginary paper market as to neglect product, service and labor in the first place.

Political reporting, like every other kind of reporting, is supposed to shoot for accuracy. So read it here, all you buckaroos and buckaresses who spent a year and a half predicting a ‘close election’ and a ‘late election night’:

- The presidential race was not close.

- The battleground states were not razor-thin.

- Democrats won. It was not fifty-fifty. It was not split-the-difference.

- Republicans lost. The party has also lost name affiliation among registered voters.

- Progressives won. Where Democrats lost, it was either a Blue Dog, a Republican-leaning district, or a hard race, sometimes close, where a challenger took on an entrenched incumbent. As mentioned, Alan Grayson won.

- The right wing lost. As mentioned, Joe Walsh and Allen West lost. So did Todd Akin and Richard Mourdock, although their brand of conservatism differs from the ugliness of Walsh and West.

more later