The last word on special tax deductions for filers like Mitt Romney

[Update Mon. Nov. 5

Actually the last word on Romney’s taxes may be this Dutch article of today. The Volksrant reports that Romney lessened his tax pay-up by almost a hundred million Euros, by using tax mechanisms routed through the Netherlands as written earlier.]

The last pre-election word on Mitt Romney’s own tax arrangements may be this article published by Bloomberg Oct. 29. Overshadowed by Hurricane Sandy, the report–“Romney Avoids Taxes via Loophole Cutting Mormon Donations”–once and for all clarifies how Romney could, indeed, get away with paying no income tax for years on end.

In pertinent part,

“The charitable remainder unitrust, as it is known, is one of several strategies Romney has adopted over his career to reduce his tax bill . . .

In this instance, Romney used the tax-exempt status of a charity — the Mormon Church, according to a 2007 filing — to defer taxes for more than 15 years.”

“In general, charities don’t owe capital gains taxes when they sell assets for a profit. Trusts like Romney’s permit funders to benefit from that tax-free treatment . . .”

“When individuals fund a charitable remainder unitrust, or “CRUT,” they defer capital gains taxes on any profit from the sale of the assets, and receive a small upfront charitable deduction and a stream of yearly cash payments. Like an individual retirement account, the trust allows money to grow tax deferred, while like an annuity it also pays Romney a steady income.”

“CRUTs were more common in the 1990s when capital gains rates were higher. In 1996, when Romney set up his trust in Massachusetts, the federal rate was 28 percent, compared with 15 percent today. At the time, a Massachusetts state resident who sold shares for a gain of $1 million could have faced a combined state and federal capital gains tax of as much as 40 percent, reducing his take to $600,000.

By contrast, if he contributed the stock to a CRUT, and it sold the shares, it typically wouldn’t owe any tax since it is a charitable trust. The CRUT could reinvest the $1 million and earn a return on the full amount.

“The power of this is the tax deferral,” said Jay A. Friedman, a partner at accounting firm Perelson Weiner LLP in New York. “The money is all growing tax free and he only pays tax on what is distributed to him.”

Concerned that CRUTS weren’t sufficiently philanthropic, Congress mandated in July 1997 that the present value of what was projected to be left for charity must equal at least 10 percent of the initial contribution. Existing CRUTS weren’t affected by the new law.”

As mentioned, Romney set up his trust in 1996. Looks as though his financial advisors were keeping an eye on upcoming developments in Congress.

Speaking of those–

Romney’s own tax returns are only one side of the Romney tax story in election 2012. The other side of the Romney tax story is, as ever, the question of what action a Romney-Ryan administration would take on tax policy. On that side of the story, there has been no last word.

We do know that Romney’s silence, and his past actions, have left an awful lot on the table, ‘on the table’ meaning to be carved up by the same harpies who brought us the Iraq war. Much harm can be done to the big middle of the working class in America under the guise of budget-cutting–just as many windfalls accrue to the undeserving few under the guise of promoting growth. ‘Austerity’ and ‘growth’ are two sides of the same bogus coin. A national economy should meet our needs as a nation, not shoot for some target abstraction or imitate the endless game of ever-boosting stock prices as an index of ‘performance’. The Greek root for economy is oikos, the household.

The candidate

If the Romney candidacy stands for anything, it stands for exactly the opposite of meeting our needs. It stands for–if anything–boosting torque in a series of boom-and-bust markets, supporting a temporary marketplace rather than supporting the national economy. Right now, we have only inconsistent or evasive statements from Romney on some of the most important middle-class tax breaks–including the mortgage interest deduction on first homes, and the capital-gains exclusion on first home sales–or no statement at all.

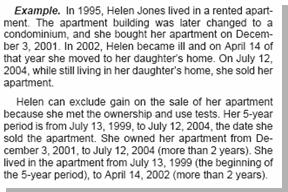

Capital gains exclusion for home sale

On the other hand, it’s interesting how much we do know about Romney.

We knew back in August that Romney is cheerfully cognizant of tax loopholes for big business. In August, he said with absentminded candor that “big businesses are doing fine” because they can always use loopholes.

Romney hitting the marks

We learned in September, when Romney released a couple of partial returns, that in 2011 his own trust received more from the federal government than it paid. Thus we know–again–that Romney is not all that worried about ‘takers’, when they’re people like him. Again we know that Romney is less than worried about the national debt, since he as another purchaser of U.S. Treasury notes was willing to add to it. Here for convenience again are the documents:

total adjusted gross income: $13,696,951.

biggest income source: capital gain: $6,810,176.

next: dividends: $3,649,567.

next: interest: $3,012,775.

The 2011 W. Mitt Romney Blind Trust return:

top line: U.S. Government Interest: $652,018.

U.S. Government Interest reported as Dividends: $12,027.

thus a total of $664,045 from our govt.

top line usgov interest: $662,115.

usgov interest reported as dividends: $90,461.

total $752,576.

The 2011 Ann D. Romney Blind Trust return:

top line usgov interest: $362,701.

usgov interest reported as dividends: $156,157.

total $518,858.

As written before, the Romneys’ federal interest income comes to one-seventh, or 14 percent, of the adjusted gross income declared on Romney’s IRS return for 2011. Romney’s income tax burden was almost exactly offset by interest income the Romney trusts received from the U.S. Treasury.

Looking at the same thing another way, without the federal interest income, his adjusted gross comes down to $11,239,472–and that’s just the interest on those U.S. government products. The face value of the Treasury bonds, notes or bills does not have to be reported, nor the purchase date or the type of Treasury product.

We knew in 2011 that Romney was less than forthcoming on the heated fiscal debate in Congress. Candidate Romney stayed out of the debt-ceiling fight. He stayed out of the disputes between House leadership and mad-dog Tea Party representatives over the federal budget. He stayed out of disputes between the House and the Senate. Remarkably, he even stayed out of most disputes between Democrats and Republicans. He was inconsistent on Paul Ryan’s budget, and statements between the nominee and his pick for vice president have yet to be fully aligned. That is, the two Republican candidates have not bothered to align their differing positions, even for public consumption.

By 2012 we did have Romney’s explicit statement that he would not release his tax returns if he were nominated. Romney stuck to this (one) position even under serious pressure from his own side.

As to the Romney track record on fiscal management, its main component is Bain Capital. We have long known that Bain Capital benefited from taking over debt-ridden companies. We knew that Bain profited from big employee layoffs, from the bankruptcies of other companies, and from off-shoring. We have long known that Romney himself is aware of the political liabilities in his track record, as his varying accounts of his relationship with Bain Capital indicate. He had fielded questions about Bain before running for the White House. He has been only somewhat less evasive about Bain than about his own taxes, and only somewhat less evasive about his own taxes than about his preferences on future tax policy.

Regardless of any differences on detail, as we know, by the end of March Rep. Ryan endorsed Romney. Ryan could read the map on demographics. There was no possibility of a Santorum win.

There was a little more mystery in Romney’s choice of running mate. Maybe not all that much, though. We saw Romney come out with the Ryan announcement after being blitzed over a few days by the Wall Street Journal, National Review writer Rich Lowry, and the Weekly Standard, all urging him to pick Ryan.

So much for tacking to the middle.

So much for winning, as far as that goes. In choosing Paul Ryan, Romney did not play to the electorate. He played to some rightist media personalities and to officeholders who are future lobbyists.

To sum up: The foregoing does not add up to a candidate with a vision of government of the people, by the people, and for the people.