Ties with Team Bush part 2

Continuing previous posts

This seems like as good a time as any to follow up on previous post on Mitt Romney’s non-released tax information and Romney’s quiet, long-time, scantly reported but extensive ties to the George W. Bush team. For one thing, Bush recently announced that he will be visiting the Caymans just before the election.

Bush to address tanned investors

Amidst the hubbub on the front lines and the day-to-day movements of polls, Romney has succeeded in remaining closeted about his finances. It’s one thing he has been consistent about. It is safe to say that Romney has achieved the distinction of being by far the most secretive of any major-party candidate running seriously, if that’s the word, for high office. Richard Lardner reported back in February that Romney did not release names of his bundlers even after President Obama did so. As we know, the pattern extends to Romney’s tax returns–with the exception of partial returns for two recent years–and of course to the para-political organizations including ‘super PACs’ supporting Romney and the GOP even while capital stays on the sidelines when it comes to investing in business. (So much for GOP talk about ‘small business’.) Thus one of the wealthiest men in America, a long-time politician with extensive financial and political connections to the wealthiest members of the GOP in the finance and communication sectors across the country, can run for the White House without ever being called to account on his own financial track record.

Imagine what they'd say if this pic had Obama in it

Up top, let me say that this situation would be destructive even if Romney had established his track record in something other than his peculiar line of finance. The lack of transparency and accountability would be destructive even if Romney had been engaged in manufacturing, like his father, instead of in short-term paper losses to enlarge long-term gains, largely at other people’s expense. But it does not help that Romney’s track record includes so much gain for him, pain for others.

Romney to Detroit

Today’s history lesson

Remember one of Romney’s successful turnarounds in the 1990s, his temp work returning from Bain Capital to Bain & Co.? That turnaround came partly at the expense of the then-Bank of New England and partly at the expense of American taxpayers.

Bank of New England had already gone bankrupt following its dealings with Bain & Co., where Romney worked before forming Bain Capital with several colleagues (including T. Coleman Andrews III of a close Bush-connected family). Bain & Co. had lapsed on covenants with Bank of New England. But notwithstanding that the company had contributed to the bank’s failing, Romney’s work at Bain & Co. included getting Bain’s debt to Bank of New England reduced from $38 million to $28 million.

FDIC

Bank of New England, in Chapter 7, had already been seized by the Federal Deposit Insurance Commission (FDIC). The failure of the bank and its sister banks is the sixth largest bank failure in U.S. history, thus far. From Investopedia:

“At the time, the BNE was the 33rd largest bank in the U.S., and including its sister banks, it had assets totaling $21.8 billion and deposits totaling $19 billion. As with most bank failures, a bad loan portfolio triggered BNE’s downfall.”

The bank’s bad portolio included Bain. Thus what Romney’s negotiating means, in plain English, is that Romney succeeded in getting Bain’s bill to the American taxpayer reduced by $10 million. Romney’s negotiating tactic was as simple as it was unsavory. Bain & Co. at the time was in dire financial straits–explaining why Romney was brought back on board. Romney turned the minuses into pluses, using them as leverage against the FDIC: He threatened to use Bain’s remaining funds for bonuses to (end-stage) Bain executives.

Back to 2012

As written earlier, there are undoubtedly several reasons why Romney doesn’t want to release his tax returns–or any financial records, except the partial recent tax returns from two presidential-campaign years. One is that open records would clarify the close ties between the Bush and Romney teams over the years. Even a quick look at Romney’s business career shows that Romney’s interests have been tied closely to Bush’s. Previous posts dealt with entities including CaterAir–the Marriott spin-off that pretty gave Dubya his business career–and World Corp, South African Airways, and InteliData, where business relationships between the Bush people and the Romney-Bain people proliferated. Predictably given its Marriott ties, CaterAir has retained ties with Bain Capital over the years. See for examples corporate bios for Bain alumni from an SEC filing. One is an alumna of CaterAir, Graham a co-founder of Bain. This filing dates from the 2005 merger of InteliData and Corillian Corporation. InteliData, with Bain alum John Backus on board, became Coriallian; Corillian bought CheckFree, now FISERV.

Two candidates

To reiterate, in narrow political terms it does not benefit the Romney campaign to be tied too closely to the Bush years. It is beside the point that some recent polls have suggested that Romney is more of a drag on Bush than the other way around; during the past four years leading up to election 2012, the smart money would have seen it the other way around. Clearly the Romney campaign did. Team Romney has been working with GWBush alumni quietly, behind the scenes (as in the machinations in Virginia). By and large, the Bush and Cheney clans have not co-appeared out on the campaign trail with Romney and Ryan. Nor have the disgraced neo-cons left over from the Bush administration, who have nowhere else to go–and have flocked to Romney.

More on that later.

The fiscal and political Bush-Romney relationships have been thick on the ground in northern Virginia, and the D.C. suburbs in Virginia are the major political and financial hub for state and national GOP. Small wonder rival Republican candidates for the White House in 2012 could not even get on the ballot in the Birthplace of Presidents. Except for the well-organized Ron Paul, no one had the skills to compensate for Romney’s lock on what is politely called the establishment in Virginia, i.e. the nexus of corporate, NGO and political links between candidates and their financial support in Virginian suburbs of Washington, D.C. Owen Wister must be rolling over in his grave.

Not that northern Virginia is the only spot. Let’s start with a loose thumbnail of some other Bain investors over the years. The list includes Reynolds DeWitt & Co.

Thus Romney-Bush ties also take us to Dallas, Texas, home of a financial company with the Dickensian name Crimstone Partners (not to be confused with a fantasy character aptly named Crimstone). Here is the company self-described, from one of numerous publicly released statements:

“About CrimStone Partners

CrimStone Partners is a special purpose private equity partnership designed to find, acquire and build companies.”

[sound familiar?]

“The fund’s investors consist of more than 35 highly distinguished business leaders, senior investment bankers and private equity professionals from firms such as Morgan Stanley, LazArd, Dresdner Kleinwort Wasserstein, Bain Capital, AEA Investors, Allied Capital, Seven Rosen Funds, Blum Capital and CIBC.”

CrimStone has substantial ties to Ohio–where the good Sen. Sherrod Brown is enduring an avalanche of attack ads, and where GOP efforts to limit accessibility to voting were successful in 2004.

“CrimStone’s largest investor is Reynolds, DeWitt & Co., an investment firm in Cincinnati, Ohio, whose current holdings include basic manufacturing businesses, national franchise holding companies, real estate developments and a professional sports franchise.”

CrimStone has a claim to fame aside from the colorful name: Its main investor is the firm that backed George W. Bush throughout his business career, bailing him out at critical junctures, and made him a millionaire. Reynolds, DeWitt & Co., as noted, has ongoing business ties with Bain Capital (where, Romney emphasizes, he no longer works). Both Mercer Reynolds and William DeWitt support Romney for president in 2012. No surprise there; they supported him in 2008 against Sen. John McCain, too.

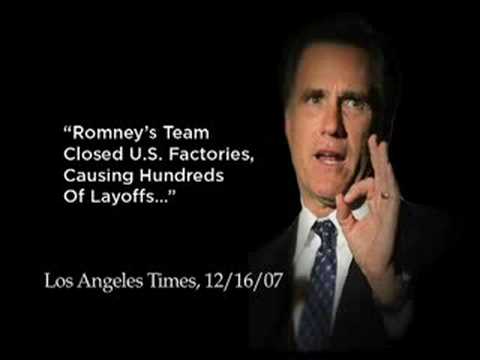

Anti-Romney ad in 2007

DeWitt, founder and co-chair along with Reynolds of Reynolds, DeWitt & Co., has continued to donate in the 2012 election cycle–$86,950 in this election cycle so far, according to figures provided by the Center for Responsive Politics. Reynolds, like DeWitt a pillar of Ohio’s GOP establishment, is on the roster of Romney for President. Each donated almost half a million dollars to GOP candidates and committees from 1990 through 2006, according to CRP.

It is no surprise that longtime local businessmen and state GOP honchos would be GOP donors as well. But donations are only a small part of the story. Straight-out donations pale particularly in comparison to what Reynolds and DeWitt did for George W. Bush, in both business and politics.

The story is long, chock-a-block detailed, and has been written about elsewhere. Condensed, it reads as the story of a political-financial relay team, members effectively poised at each juncture of George W. Bush’s career to hand him the life-saving water bottle or more significant resource, primarily financial backing and political apparatus. A few quick examples of many:

- In the mid-1980s, Bush’s oil exploration company was bailed out by Reynolds and DeWitt.

- Also during the 1980s, DeWitt and Reynolds were among the Ohio investors brought in to back Bush’s purchase of the Texas Rangers baseball team.

- GWBush received $42K year in consulting fees from Harken Energy, backed by Reynolds and DeWitt.

- The relatively unknown Harken Energy also received a surprising opportunity to drill in Bahrain.

- DeWitt was Bush’s partner in the Texas Rangers venture.

- Reynolds was national finance chairman for the 2004 Bush-Cheney presidential campaign.

- Reynolds co-chaired Bush-Cheney’s presidential inaugural committee.

Oil rig, Ship of state, the bloody son

For the record, Reynolds became GWBush’s ambassador to Switzerland and Lichtenstein, 2001-2003. A reward of ceremonial appointments, however, is dwarfed by the favorable tax policy bestowed by the Bush administration on long-time Bush cronies and their companies.

As with Romney and his Olympics stint, Bush was able to base a claim of business experience on his Texas Rangers. As with Romney and Bain’s dealings with Bank of New England, Bush was able to get significant taxpayer help–Texas taxpayers and the City of Austin provided the stadium where Bush’s baseball team played. And as with Romney and some failed former Bain companies, Bush exited some companies carrying away gain for self while leaving the losses for others. It’s been called “vulture capitalism” for a reason. We could call them vulture political scions.