THEY ARE TRYING TO WATER THE DOLLAR WHILE PRETENDING THE SKY IS FALLING

–One by-product of the bailout bill, as independent journalist Dave Lindorff has pointed out, is the enormous effect it would have on the U.S. dollar. As traditional and iconoclastic economists both know, a net effect of pumping hundreds of billions of dollars into the economy all at once, when that money has to be borrowed from abroad, is inflation.

Not the kind of ‘inflation’ hawked as a bogeyman in connection with wages–CNBC just aired an interesting stat that the median salary of white men in their thirties declined 12 percent from 2004 to 2007–but genuine inflation, the kind you get in Germany at the collapse of governments between the wars and at the collapse of the Third Reich. The kind where citizens joked, gallows-humor style, that they had to fill their grocery carts with Marks (currency) to buy a single head of cabbage.

The line being taken on the airwaves is that ‘the markets’ need to be ‘reassured,’ ostensibly so that lending money can happen. Meanwhile–somewhat rebutting the sky-is-falling line, one would think–small banks are lending money to local customers quite successfully, regional banks are doing well compared even to this past summer, and the stock market opened sharply higher this morning.

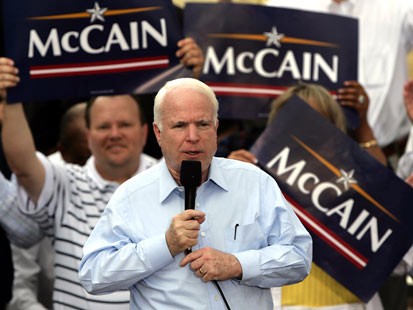

Certainly we need to take some specific financial measures, in our own national interest. Raising the cap on single bank accounts insured by the FDIC (Federal Deposit Insurance Corporation) from $100,000 to $250,000 probably would be a good idea. This item is currently proposed by Barack Obama and agreed to by John McCain. It has been proposed before, and could have been done any time in the past eight years.

One key solipsism being fed out to the public via the air waves right now, though, is that only a sweeping, omnibus piece of legislation will do the trick. As the argument goes, implicitly, omnibus legislation is needed, even though 1) there is no guarantee that it would work, 2) the details of how it would work have yet to be clarified, and 3) what was the third?–oh, yes: the proposed legislation itself is unclear.

There must be a lot of Congress members panicking over the prospect of 401Ks losing money in the stock market. But the biggest supporter of the bailout package, be it noted, is George W. Bush. Cable networks supported by Wall Street advertisers also support it. Some major newspapers support it, backed by their biggest investors.